Weston Snowboards 2023/24 Preview

Retail Buyers Guide: Snowboard‘s 2023/24 Retail Buyer‘s Guide

Brand: Weston

Interviewee: n/a

How would you describe the current state of the snowboard market? What big developments, changes, challenges, and/or opportunities are you seeing and how is your brand navigating them?

It seems the current state of the snowboard marketing is seeing a rebound from the post-covid era where we saw a major shift into splitboards. Interest in solid boards is peaking again and we’re looking forward to some strong seasons, snow willing.

Everyone has been affected by raw materials and shipping price increases and transport issues. Have you had to make any significant changes with regards to manufacturing, sourcing, or logistics? Are there any examples you can share of how your business pivoted effectively? Any positive developments with regards to these issues and the changes you’ve made?

Weston pivoted fairly effectively through the pandemic and supply chain issues. We’ve continued to be on par or ahead of larger brands that we compete with in the industry in terms of delivery to our retailers. This has largely been facilitated by just anticipating delays and being more proactive in the placement and forecasting of our orders.

After two years of heavy carry over in the industry and more of a return to normalcy last season, what’s your overall sales and production/inventory strategy for 23/24?

The industry has long been dominated by this churn and burn of topsheet graphics that obsolete the previous season’s boards and destroy margins while driving unnecessary consumerism and impact on our planet. Thus, in 22/23 we split the line into two categories – our Quiver Series and our Mission Series. The Quiver Series will represent a 2 line with a minimum 2 year run of graphics that will retain margin for our retailers and retain a timeless feel. Meanwhile, we’ll have the Mission Series that will focus on a much smaller portion of our line that will continue to have new topsheets each year in limited quantities that have a giveback component that speaks to Weston’s values. While we have seen an uptick in direct to consumer sales, we at Weston continue to believe that a brick-and-mortar retailer is essential to providing that first experience and resource for riders entering into the resort or backcountry and we intend to ensure that those shops that understand this role remain supported.

Do you anticipate any shifts in the ratio of e-commerce sales vs. brick-and-mortar sales now that most Covid-19 restrictions are gone?

We expect that some of the direct to consumer sales will remain, but a good chuck will return to in-person.

Does your brand have any new developments concerning sustainability and/or how you are positioning any environmental messaging?

We continue to strive towards incremental improvements in sustainability from fully recyclable packaging, to offseting our carbon footprint, and eliminating of harmful/toxic chemicals in the manufacturing process. We are 1% for the Planet members and contribute every year to improving our planet in whatever ways we can. However, when it comes to the guts of a snowboard, consumers need to realize that that board is going to end up in a landfill at the end of the day. The best thing this industry can do, and Weston continues to do, is ensure that boards are built to last. In addition to this, and as part of our 1% for the Planet commitment, we’ll be teaming up to create the Haa Aaní Alliance in collaboration with Zeal Optics, Smartwool, Pret Helmets, and mountainFLOW Eco Wax in the 23/24 season to launch a campaign we’re coining as the Salmon Way of Life. In working with an indigenous artist in Juneau, Alaska from the Tlingit people, we’ll be releasing a collection of artwork and products with a giveback component to protecting salmon habitats and waterways.

What trends or developments are you seeing with regards to board construction, shapes, and general innovation? How is this shaping your 23/24 range?

We are seeing continued interest in the short/fat portion of our lineup. The Hatchet now only slightly tails the Backwoods in terms of our most viewed snowboards.

Are you using any new materials in your hardware for 23/24? If so, what and why? We’re interested in anything new in inserts / edges / cores / sidewalls / glue / resin/ wood types / base material / top sheet / etc. here.

No

Any new design or pattern approaches in your 23/24 gear? Any collabs on the line?

As mentioned above, we have a major collab coming that we’re calling the Haa Aaní Alliance. Haa Aaní means ‘our land’ in Tlingit, the language of the indigenous people of Juneau, Alaska. This collab is between Zeal Optics, Smartwool, Pret Helmets and mountainFLOW Eco Wax.

What product range or offerings are you focusing on the most for 23/24 and what aspects of the market are getting the most interest?

We’re continuing to focus the majority of our effort into our powder and freeride categories.

Are you placing any focus on entry-level products? If so, why and how does this compare to previous years? What is your assessment of the youth market?

With Weston being a niche brand in the solid snowboard space, we’re continuing to focus on our high end models vs. entry level.

Pricewise, which area of the market do you cater to? What developments are you seeing with regards to product pricing?

We cater to the mid to high end realm of the snowboard industry and have seen just slight adjustments to account for global inflation issues.

What are your top product marketing stories for next season?

As part of our 1% for the Planet commitment, we’ll be teaming up to create the Haa Aaní Alliance in collaboration with Zeal Optics, Smartwool, Pret Helmets, and mountainFLOW Eco Wax in the 23/24 season to launch a campaign we’re coining as the Salmon Way of Life. In working with an indigenous artist in Juneau, Alaska from the Tlingit people, we’ll be releasing a collection of artwork and products with a giveback component to protecting salmon habitats and waterways.

Japow-Hokkaido

Best Sellers/Hero/Key products

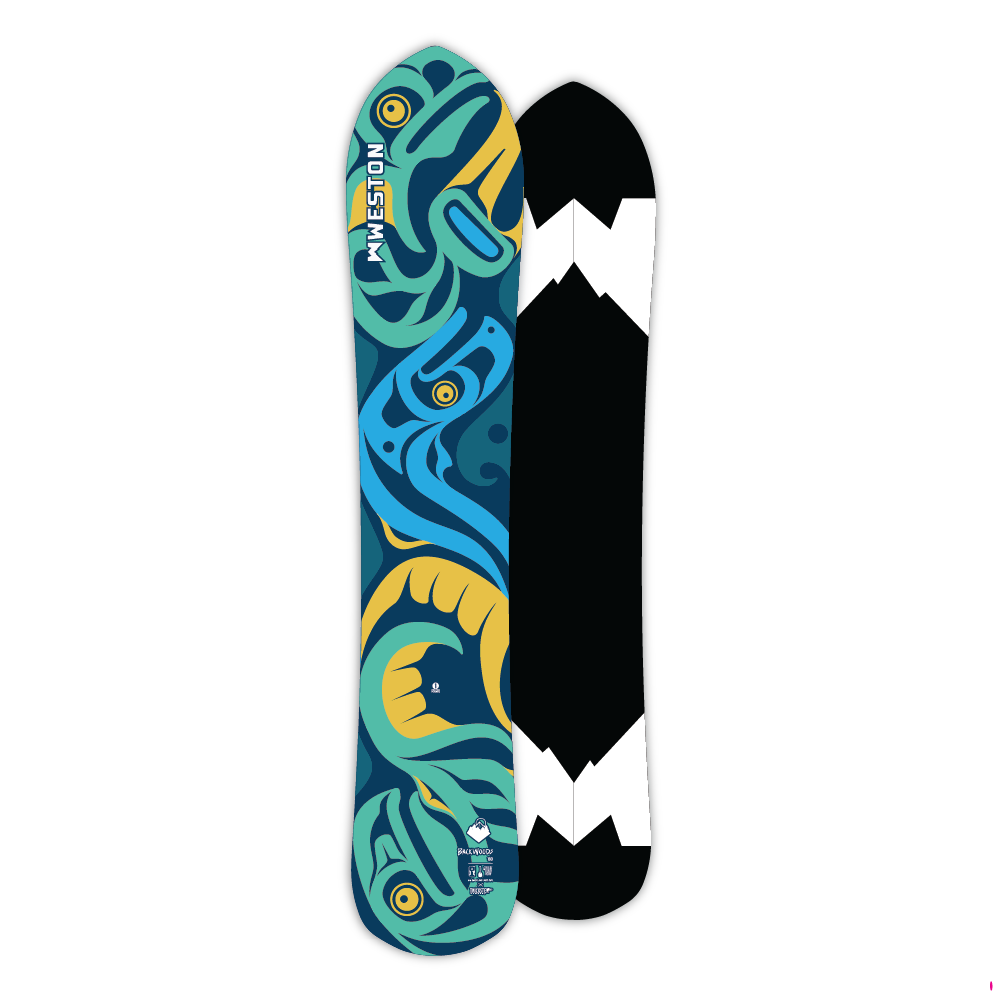

Backwoods Splitboard x Haa Aaní Alliance – The Mission Series version of Weston’s best-selling Backwoods Splitboard – a powder and freeride hybrid. This board will feature iconic graphics known to the pacific northwest, collaboratively and responsibly created in tandem with local, indigenous artist Crystal Worl of Trickster Company. The form line drawings of the traditional representation of salmon tell the story of the salmon way of life.

Backwoods-Trickster

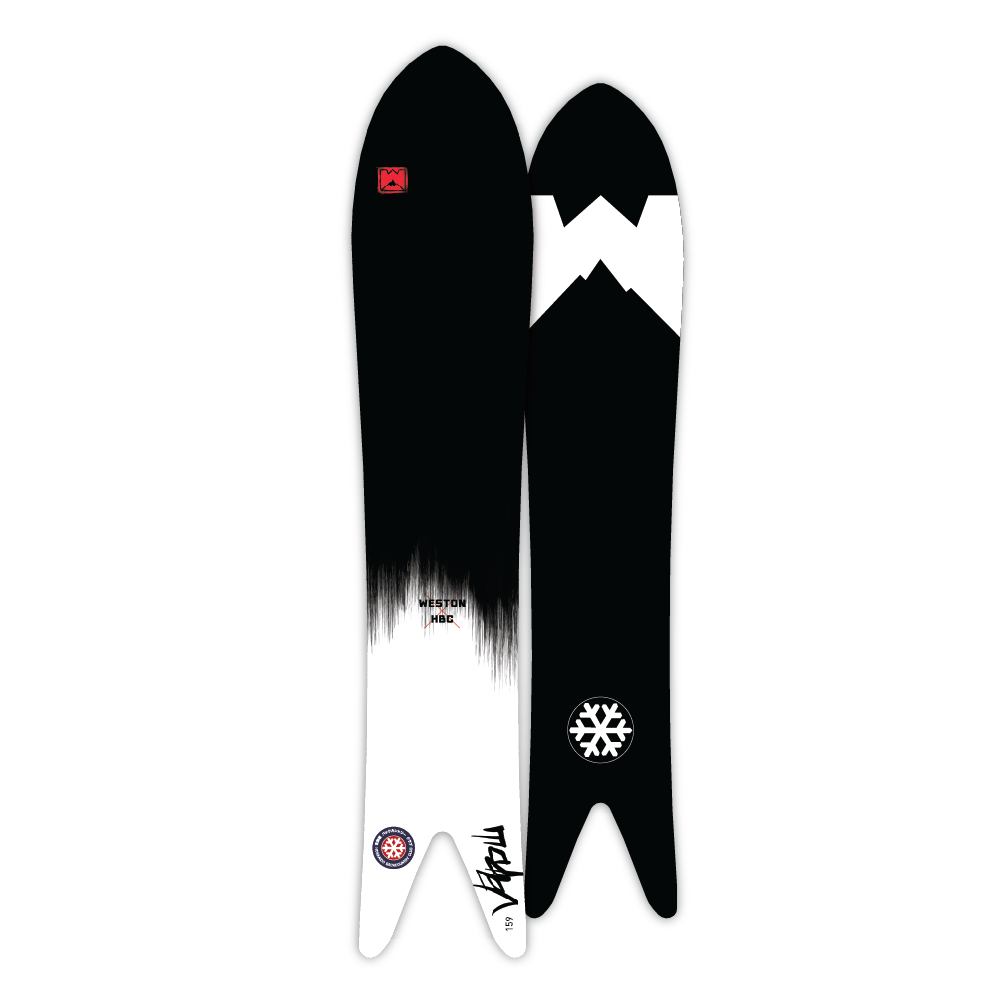

Eclipse Splitboard x Haa Aaní Alliance – The Mission Series version of Weston’s best-selling Eclipse Splitboard – a powder and freeride hybrid. This board will feature iconic graphics known to the pacific northwest, collaboratively and responsibly created in tandem with local, indigenous artist Crystal Worl of Trickster Company. The form line drawings of the traditional representation of salmon tell the story of the salmon way of life.

Eclipse-Trickster