Drake Snowboards 2024/25 Preview

Retail Buyers Guide: Snowboards FW24/25 Retail Buyer’s Guide

Brand: Drake

Interviewee: Davide Smania, Product & Marketing manager

OVERALL

How would you describe the current state of the snowboard market? What big developments, changes, challenges, and/or opportunities are you seeing and how is your brand navigating them?

Snowboard market is stable, also for our sales. We just introduced two models which are a more affordable version of already existing ones, same shapes but with simplified construction in order to serve also those customers which don’t have a big wallet. Being value for money is always well appreciated in this economic situation, not everyone can afford an expense of 500 euros or more for a snowboard.

Following overall price increase, any positive developments with regards to manufacturing, sourcing, or logistics and the changes you’ve made? Are there any examples you can share of how your business pivoted effectively? What developments are you seeing with regards to product pricing?

We started a partnership some years ago with a trusted supplier and this is rewarding us in terms of quality and delivery time. Building a good relationship is fundamental in terms of supply chain, not just to have more stable quotations, but also for other mentioned key points.

As explained in the first question, we are proposing in the new collection the Battle and Shot models which are using same shapes of the more famous existing models, but with a simplified construction and less technology in order to be more affordable.

Is e-commerce sales still strong since most brands have been put a lot of effort in physical retail?

For us the e-commerce is more a way to serve our customers in those nations where we are not distributed. Traditional sales channel is so important to provide the right level of service and consultancy to consumers, we are selling technical products in the end.

After last winter and the lack of snow in Europe, what’s your overall sales and production/inventory strategy for 24/25?

Compared to other product categories, our snowboard sales weren’t affected by this lack of snow, so we decided to enlarge our offer in the mid-range level in order to better serve this segment.

SNOWBOARD SPECIFIC

What trends or developments are you seeing with regards to board construction, shapes, and general innovation? How is this shaping your 24/25 range?

It seems that particular shapes and geometries gained their niche, but in general we noticed a certain interest in having versatile boards you can ride and have fun in different conditions. We are covering different shades of the all mountain category and instead of proposing new shape, we decided to propose other versions of existing models with a more affordable construction.

Anything new concerning sustainability and related product or construction you would like to highlight?

Our supplier has a factory which was recently built in order to be efficient and not have a waste of energy and other natural resources. For example during SMS production period they are able to use just part of their facilities, there are no big rooms or areas, everything is splitted in modular areas so they can “activate” just what they need.

Are you using any new materials in your hardware for 24/25? If so, what and why? We’re interested in anything new in inserts / edges / cores / sidewalls / glue / resin/ wood types / base material / top sheet / etc. here.

No really. It’s still complicated to produce a snowboard in a full green way, but we are focused on making durable goods. For example using injected TPU instead of ABS on sidewalls makes the board more resistant on impacts based on our statistics.

Any new design or pattern approaches in your 24/25 gear? Any collabs on the line?

We are involving more and more our riders in the creative process, some of them are also providing inputs and also drawings for those boards they are using more. Kohei Kudo is making the graphics by himself, same for the Battle Rusty where Alex Stewart took inspiration from Leonardo’s projects and drew the whole graphic. But also DFL Pro and Tao’s graphics are based on our female team riders and Simpson bros’ inputs. In general snowboards’ graphic are more abstracts.

Are you planning to focus on a special product range or type of customers? What’s your newest range?

We are cover the mid-range in a better way with two new models based on simplified construction of well appreciated models sharing the same shape.

What is your top product marketing story for next season?

Bringing on collabs with riders and crews, as mentioned above Battle Rusty with Rusty Toothbrush crew, Team Kohei with Kohei Kudo, DFL Pro with our female team riders, Tao of Drake with Simpson brothers. Graphic designer Dasha Plesen was involved on DFL, DF Pro and DF with her mildews creations (https://www.instagram.com/dashaplesen/).

Best Sellers/Hero/Key products

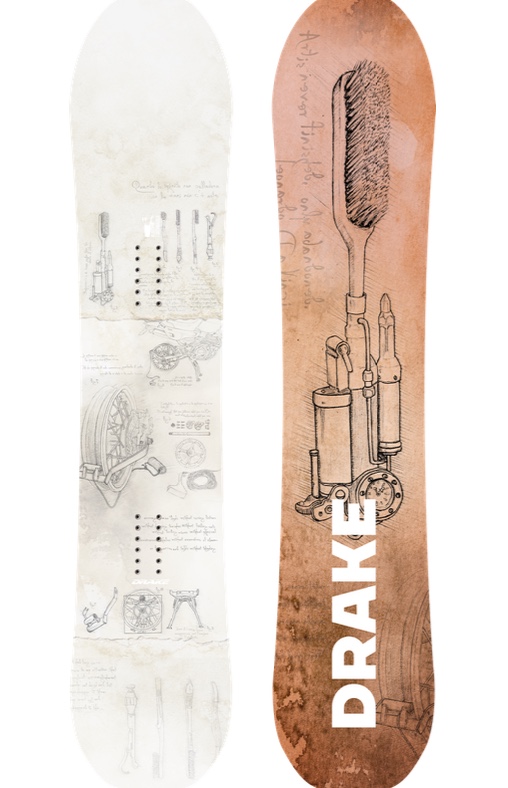

Battle Rusty

This model is at its fifth edition, improved through several editions thanks to Rusty Toothbrush riders’ feedbacks, is the perfect board for those who are looking for a Freeride/Freestyle board, working in excellent way in all conditions, from streets to backcountry. This board is soft at low speeds so you can press it how you want it, but providing a great pop thanks to the carbon bar if you wanna go big.

BATTLE RUSTY

Team Kohei

Nine years are already passed since we started with this Promodel. Based on the regular Team model construction in order to meet our rider’s preference in terms of graphic and style, drawn by Kohei in person, it’s an awesome versatile allmountain, so stylish like the rider is putting the name on it.

TEAM KOHEI

Tao of Drake

Our unisex jibby board has been updated with a softer flex in order to be a real buttery stick. Used by a lot of riders in our team, from Nata with the smallest size 145 up to Simpson bros with 154W, having tons of fun is assured if you have it under your feet.

TAO