Report On COVID-19 Impact & Trends In Sporting Goods Industry

The World Federation of the Sporting Goods Industry (WFSGI) has conducted a confidential survey (and will do so monthly) covering the impact of COVID-19 on sport industry businesses around the world. Subsequently, the report will give insights into trends through lockdowns, the gradual easing of restrictions and the return to the ‘new normal’; hopefully avoiding relapse. Results from the March/April are below:

COVID-19 Manufacturing Trends

- Supply Chain Disruption: Supply chains seem to be mostly affected in Far East (68%), followed by Europe (64%), South Asia (54%). Supply chains in Northern America are only affected for 22% of respondents and in Latin America less than 10% have seen an impact on their supply.

- Order Decrease: Around 90% of respondents see decreasing orders from customers in Europe and the Northern America. This number is significantly lower and around 30% for Latin America, Far East and South Asia.

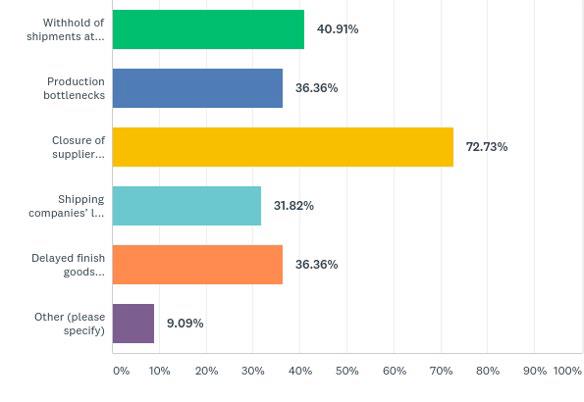

- Material Shortage: Over 70% of respondents face material shortage due to the closure of suppliers’ companies. Around 40% face issues due to shipments being withhold, due to specific trade restrictions or delayed finish goods transportation. A little over 30% have to cope with a lack of capacities of shipping companies.

LOGISTICS: SIGNIFICANT MATERIAL SHORTAGE

- Labour: Close to 60% of respondents see a labour shortage due to forced company closure, however, none have infected staff members not showing up to work. A little less than 30% face labour shortage due to travel restrictions for workers and shut down of public transportation for workers. Around 20% have seen staff not coming to work since they have to take care of family members or are reluctant to return to work due to fear to be infected.

- Regulatory Requirements: Over 86% are impacted by specifically implemented regulations due to the COVID-19 pandemic.

- Finance: Again, over 86% are challenged by low cash flow. This issue is caused due to extended payment terms and order cancellations, orders that are not delivered in time and since salaries are being paid in advance. Interesting is, that even though close to 50% will restrain from investments, 40% plan to invest in software and people and close to 30% invest in infrastructure.

- Business Forecasting: None of the respondents predicted that there is no impact on their business. Most of them, close to 50%, see their business dropping by 50% in the upcoming month. Around 15% expect even a 70% – 80% drop. The more optimistic 22% of the respondents expect a drop of maximum 20%. The most affected region for respondents is Europe where 95% see a drop of their business. In Northern America 77% expect business to decrease, while for Asia only 30% see a decrease of business followed by Latin America with only 18%.

- Business Rebound: Respondents were rather pessimistic when it came to assess if their business will take off again after the pandemic. Most of them, close to 40% only expect that their business will rebound by 10%, a business rebound reaching 20% and also 50% is expected by a little less than 30%. Less than 5% expect their business to reach 90% of its former performance. None is expecting to reach 100% of their initial business performance. Less than 30% think that they will only need 61-90 days to get back to business after the pandemic. A majority of 60% foresee a time frame of 91-180 days. Close to 10% even would predict that more than a year is necessary.

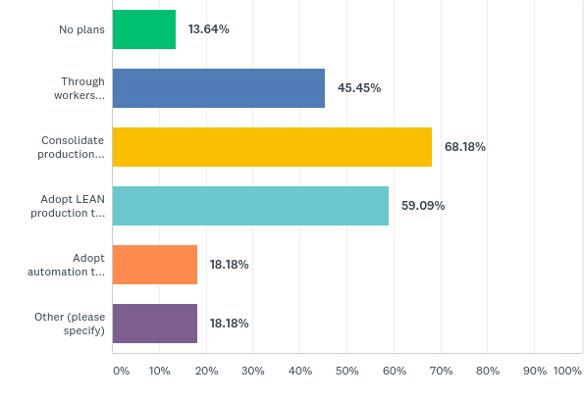

- Measures Taken: Close to 70% will consolidate production capacities as a response to the pandemic. Nearly 60% will focus on adopting lean production to eliminate waste. Over 45% will need to look into worker retrenchment. Automation is a solution for close to 20% of respondents and finally, less than 15% have no specific plans.

MEASURES TAKEN: KEY INSIGHTS

COVID-19 Brand/Retailer Trends

- Mitigation of Impact: Close to 80% want to increase their online sales. 47% will reduce their demand by cancelling orders in the following months. Around 40% will clean out all inventories to maintain their cash position and exploit market opportunities in the recovering Asian markets.

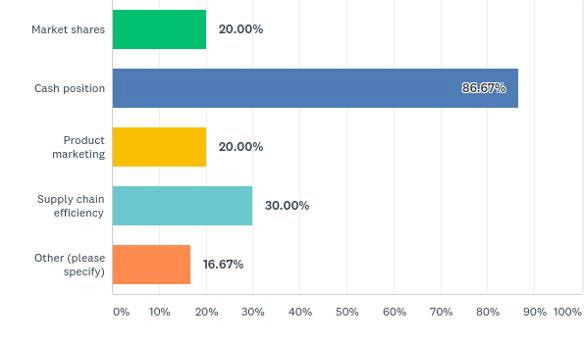

This will lead for 60% of respondents to deferred payment flows. Over 50% would opt for sharing the pains by keeping the same supply base but provide for less business volume for each supplier. Still, 30% are looking to consolidate the supply base and keep only strategic partners. - Priorities: Close to 90% will focus on cash position while 30% are increasing their supply chain efficiency. 20% will look into product marketing and market shares. It was also mentioned that temporary unemployment for some staff supported by government payments is an option.

Priorities: Key Insights

- Expectations to Suppliers: Most respondents, 90%, are welcoming flexible suppliers while around 25% are awaiting efficiency and stability.

- Supply Chain Transformation After the Pandemic: Over 70% will work on a lean and adaptive supply chain. Over 55% are looking for innovative ways to cope with disruption. 20% want to be close to market and cost sensitive.

Still, close to 40% don’t want to re-frame their sourcing priorities after the pandemic while 30% will look for a regional centric sourcing or global market centric sourcing. A little over 15% want to opt for local for local sourcing. Also, some respondents have not yet the answer to this question. - Emerging Market Trends: 70% consider environmental friendly products to be the most important market trend after the pandemic. In the same directions goes the answer of 46% which attach importance to recycle economies. Around 25% see functional driven and price points centric developments as important.

- Prevailing Sports After the Pandemic: Around 70% of respondents see running and outdoors as the most appealing sports after the pandemic. A little less than 50% consider walking to be practised most after the pandemic. Around 20% consider basketball and soccer to take that position. Finally, cycling is also a seen as a popular activity after the pandemic.