2024 SUP Retail Buyer’s Guide

The SUP industry developed surprising adaptability skills when the market was spurred with the COVID boosting demand, and similarly, in 2024 the brands quickly reacted to the saturated landscape walking a fine line between carryovers, yet innovation sprouts here and there. By David Bianic.

Believe it or don’t, 2023 isn’t over yet. While we are already mid-point in the 2024 season, many products from the previous year are still weighing on the retailers’ cash flow, and, as a domino effect, on the brands/distributors, failing to meet the orders level for the year running. Yet the whole industry chose the safe path, carrying over the same ranges, at least partially, from one year to the other, smoothing out the deep rebate issue. “While carry overs did provide some relief, the impact wasn’t as significant as anticipated”, regrets Chap Zhang, Senior Brand Manager for Aqua Marina. And for those who did manage to clear much of their inventory, like Airboard, there was a quid pro quo, as the brand had to limit new production to prevent the overstocks repeating. Thomas Schillig, Product Manager at Airboard adds that pre-orders have dropped significantly, meaning “it is up to us predict demand and inventory supply”. Quite the conundrum.

That said, keeping the market fresh remains crucial and one brand cannot but introduce new designs. Here is an example of drawing that fine line at NSP: “We listened closely to the shops to help them on their sell through while staggering the launch and introduction of new models and shapes that complemented the remaining stock on hand, but most importantly did not cannibalize or destroy value of their older stock on hand” explains Sander Blauw, Global Sales Manager. This is where experienced brands make a difference. As Monty Python once sang — “Always look on the bright side of life” – and Blauw even ponders on the positive effects of the oversupply, as the subsequent price offers helped bring new paddlers in the sports, “and we are seeing some of these customers upgrading to newer models”. Confidence is key, right? NRS sure can boast about showing confidence as they bet on innovation in these troubled times: “When the market is flooded with minimally differentiated boards being sold at discount, the only way to compete is by offering something different and better”, says NRS Chief Marketing Officer Mark Deming. Their whole range consists of redesigned iSUPs, implementing a woven Z-Blend drop-stitch material (“lighter, stiffer, and rolls up more compactly”) as well as an Integrated Shaping Technology (IST) with multiple air chambers, “to shape the boards for improved efficiency and stability”.

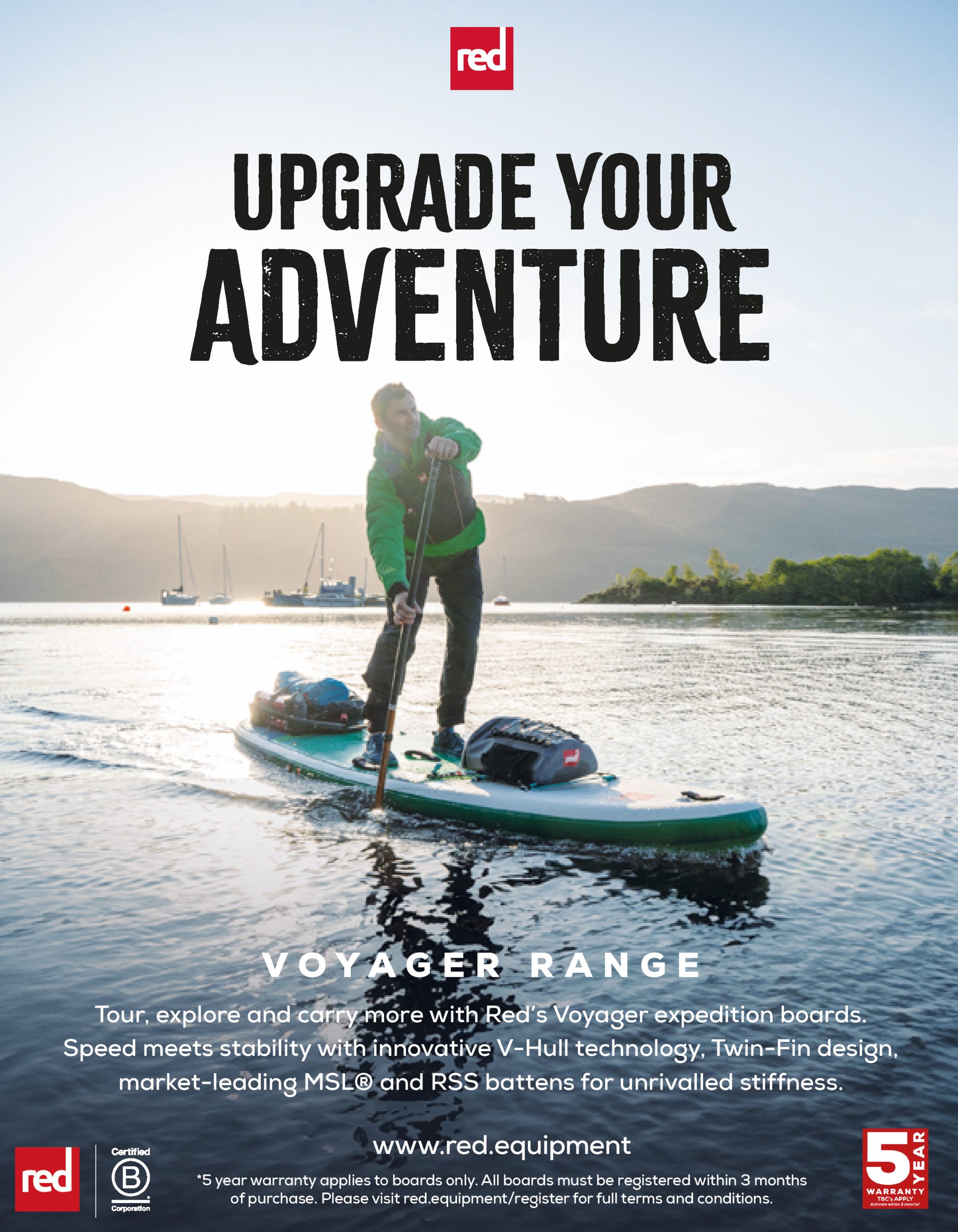

Some brands have also been putting this time to good use. Innovation doesn’t only translate into new models, and for Red Paddle Co., that meant working on their B Corporation certification. “It was a three-year process in which every area of the company was assessed, audited and scrutinized. We are continually taking steps to improve the way we design our products, reduce our impact on the planet and build a strong community of paddlers around the world”, said George Shillito, Commercial Director.

2024: the end of the tunnel?

Moving forward, we sounded out the brands to see if confidence can be brought back this year. In other words, will supply and demand balance out in 2024?

Paolo Cesari, Product Manager for Duo Boards (whose part rigid part inflatable concept will be developed later), puts the spotlight on suppliers’ practices, which doom the industry to over supply: “The search for the lowest price in production to obtain a greater sales margin has determined very high Minimum Order Quantities on the part of suppliers (almost always Asian).”

Still on the manufacturing side, Shillito at Red Paddle Co. raises a terrifying question: “Potentially a bigger consideration here is will there still be supply when existing inventories have been reduced?” Indeed, after a recent review with their suppliers, it was estimated that between 85-90% of inflatable SUP factories have closed… and we mean “permanently”. “These closures mean a huge amount of skill and knowledge is being lost meaning quality is likely to drop. Something we will not allow to happen.”

That quality level isn’t met by all brands and an inflatable SUP only has a limited lifetime says Sven Josten, Sales Manager for France at Spinera. According to Josten, the renewal of the boards will help clear the existing overstock: “I reckon after 2024 brands can start over again with fresh inventory.” Schillig at Airboard doesn’t foresee a balanced market until 2025 or latest 2026, considering the established brands are able to sustain the next two years. Kill me!

Let’s wrap up on a positive note as Andy Wirtz, owner of Norden SUP, strongly believes SUP is in transition from a trend sport to becoming a core sport, “which also means that the masses will fade, and the core remains, and that takes time. We have seen this in windsurfing, kitesurfing and we will also see this in foiling at a later stage”. He is convinced things will balance out eventually.

2024 iSUP Product Strategy

In a confused market, retailers need a straightforward strategy from their partners. Let’s hear from the SUP brands about what they have up their sleeve for 2024 regarding the inflatable category. Mistral sends a confident message with “inflatable family-focused SUP boards resulting from in-depth market research on what designs and USPs are popular and at what price point”. Their key models cover those bases with the Cozumel 11’6’’, an ideal first-time recreational SUP cruising paddleboard with kayak options, and the Aruba 10’6’’ x 33’’, a super stable family model.

Different vibe, SIC Maui appeals to more performance-oriented paddlers. Leaning on the success of its racey RS and RST hardboards, the RST Air screams speed with its new narrower shape and nose. These examples display a pattern in the iSUP market, as confirmed by Sander at NSP: “Interesting to see demand remains strong at opposite ends of the spectrum. On the one side for our entry price point boards, bringing new customers into the NSP ecosystem at a very affordable price, while on the opposite side demand remains high for our high-end inflatable race boards.”

Located in between those two categories, the inflatable touring board is a fast-growing segment as well and has even given birth to an intermediate design: all-rounders with “pointy” noses which mimic the touring outline, whilst remaining stable enough for any paddler. Add a bit of sparkle and you’ve got a great package such as the Ultimate Reef from Sandbanks Style, a 10’6’’ x 32’’ x 6’’ iSUP available in various graphics that really stands out from the bunch. Another trend proving the growing interest for touring iSUPs is Indiana splitting its offer between classic 30’’+ widths and sportier versions of the same design. Their 14’0 Touring inflatable is available in a 31’’ width and in new faster 14’0 S (with 28” width). Same thing with their top-seller, the 12’6 Touring Inflatable which will come in a 12’0 S iteration (29’’ width) and a 12’6 Ocean model “with a pronounced nose scoop and tail rocker for easy and smooth rides in wind and waves on the lakes or outside in the open ocean”, explains Nikolaus Dietrich, Head of Sales at Indiana.

Same spirit at Red Paddle Co, which has revamped its offer with the new Sport+ range, designed as an upgrade from an all-round shape, to cater the endurance/touring demand: “With mass paddling events selling out in a matter of hours across the world the Sport+ range is designed to improve efficiency, acceleration and overall speed whilst reducing drag and fatigue on longer paddles”, sums up George Shillito. Their 12’6’’ Sport+ has strong selling points: 2 kg lighter thanks to the new MSL®800 double drop-stitch material, and yet stiffer than ever, allowing a reduced thickness (4’7’’, 120 mm) for stability and a more connected experience to the water. The new Deluxe Lite drop stitch construction is also making headlines at Starboard as it’s the first “premium entry level woven drop stitch”, a technology more commonly seen on higher end models. Ollie O’Reilly, Brand Manager Starboard SUP & Foilboard, can already announce that this tech will be carried over from ‘24 into ‘25, and “has received a massive interest due to the added performance”.

Allowing us a seamless transition to the hardboard category, Duo Boards stands as quite the… uncategorisable: half rigid (in the planing part), half inflatable. The mid-to-tail section is made from moulded EPS Core and Epoxy Laminate and is connected to an inflatable mid-to-nose section. Not as slim as a regular iSUP once deflated, the board can still fit in the trunk of a car or fly in a plane without the oversize luggage fee. Paolo Cesari ensures their Duo boards have “excellent performance in the water thanks to the rigid tail. You can surf a wave in Sup or Windsurf exactly like with a composite board”. The system opened new developments in 2024 with the release of two wingfoil boards, the aptly named Foiler and Plate. The stiffness of the rear section is particularly suited to house the hydrofoil baseplate, where fully inflatable foil boards lack some rigidity under the feet.

2024 HARDBOARD TRENDS

Interestingly, the composite SUP market reveals a similar pattern as the iSUP one, with a strong demand for the entry prices and premium models. But not exactly for the same reasons. The entry-level hardboard conveys a message of durability which is quite comforting for new participants. Hitting the blade of the paddle on the rails, bumping into rocks and fellow SUPers (!) or even dragging the board on the sand are common practice and the construction of the hard SUPs have integrated this use-and-abuse. It is no surprise here that NSP’s HIT Cruiser is still the most successful model of their range. “Our HIT Cruisers remain our top sellers for B2B accounts due to their super durability and don’t require repairs each time the rails are hit (or smashed) by first time paddlers, or party goers at a resort”, says Sander Blauw.

Similarly, the soft-top models appeal to the newbies for their smooth deck and Mistral adds a fresh design in the mix for 2024 with the Go Free: “Whether riding a small wave or cruising the shoreline, the super comfortable soft deck, tri-fin setup, and cargo net allow for optimum rider usability, available in 11’6 x 32.5 and 10’6 x 32”, explains Steve West, Communications and Content Manager.

The premium race segment seems relatively immune to overstock and poor sell-out issues, as every season sees the release of new speedsters. The new SIC Maui RST (for Rocket Ship Turbo!) sits in the category, an impressive all-water race board with a dugout cockpit, made in a lightweight Super Fly moulded carbon sandwich construction. SIC Maui has also launched a more affordable version of their RS, the RS DF (Dragon Fly, moulded wood sandwich construction) which stands as “a great entry-level race board and the perfect performance touring option for those looking to go the distance in ocean conditions”, says Casi Rynkowski, Brand Manager.

Hardboards also remain the go-to platform for foiling, wingfoiling and “windsuping”, and Imagine Surf offers an interesting proposition with their bestseller, the Bula, designed by legend Dave Kalama: “The Bula was also made to be the ideal platform for anyone wanting to learn to wing or windsurf without a foil”, explains Brian Green, President. The Bula is available in bamboo composite construction and in a super durable thermo-moulded construction.

RETAILER SUPPORT

The most important support a retailer can expect from a partnering brand nowadays is the carryover strategy we mentioned earlier. In addition, a palette of tools is used by the brands to ease the business. As shop owners are obviously quite shy when it comes to pre-booking these days, Spinera offers “some really nice incentives [on pre-orders] to have a good margin for 2024”.

More flexibility is also proposed from Red Paddle Co. to save some budget: as an alternative from the package formula (board, paddle, bag, pump), a board-only option is a win-win solution for George Shillito: “It’s not only kind on customers wallets allowing them to upgrade without compromising on quality but also means they are able to buy the kit they actually need which is better for the planet.” Indiana also makes the retailers feel special as they can be identified as Indiana Competence Centres (Gold, Silver and Bronze): “These retailers can purchase demo material for special conditions”, says Nikolaus Dietrich, and get marketing support “in form of Beach-Flags, T-Shirts, Caps, Coffee Cups and much more”.

Drop shipping has gained a bit more ground in 2024, a method adopted by Duo Boards: “What we are proposing is the possibility of purchasing a board from the online shop and also sending it directly to the trusted shop, guaranteeing a profit margin without particular effort”, explains Paolo Cesari.

When the business is good, it’s a “every man for himself” situation: everyone trying to grab a bigger slice of the cake without thinking twice. Whereas in difficult times such as the one we are living in now, in the SUP industry we can clearly see some teamwork, a give-and-take approach between brands, distributors and retailers. This is solid groundwork for the days ahead and for that we shall rejoice.