Snowboards FW24/25 Retail Buyer’s Guide

We are in the heart of winter. Anticipation and excitement have reached their climax and snow is falling all over the Northern Hemisphere. And as the season unfolds, the industry faces both old and new challenges. These challenges are part of a complex system and are shaped by diverse variables, such as the economy, participation demographics, generation turnover, climate change, and lift ticket prices. Hell, you could likely earn a doctorate studying this landscape from an ethno-sociological perspective.

Despite all of these challenges, many people agree that snowboarding, as a whole, is relatively healthy. The ultimate snow toy has reached an adult age and truly earned a spot among the classic sideways activities – surfing and skateboarding. Simply put, snowboarding is now a mature industry. And this industry has reached the point in winter when the sales meetings are over and brands are pulling back the curtain on next year’s goods. Fortunately, this leads us to the next milestone of the season . . . ladies and gents, welcome to the 24/25 Retail Buyer’s Guide for Snowboards, brought to you by Matthieu Perez.

MARKET STATEMENT

Let’s dive in right away into a panel of visions and perceptions from manufacturers and brands. At GNU, Barrett Christy Cummins snowboard legend, marketing leader at Mervin, and mum to a tribe of rippers, says, “Over the past several seasons, snowboarding participation (as part of the greater outdoor sports culture) has experienced a nice lift”. She continues, “The challenge our industry faces now will be to keep all these new riders coming back each season to shred. A lot of people got in (or got back in) during the pandemic and are now looking to upgrade their equipment from rental to personal ownership, or from beginner to more advanced product. As an industry leader we see this as a unique opportunity for us to introduce snowboarders to equipment that rides better, lasts longer, is environmentally nicer, and frankly, more fun!”

Matt Stillman from Rome adds, “The current state of the snowboard market seems to be eager and optimistic. We continue to listen closely to our valued retailer partners, reps and distributors to address whatever challenges they see emerging”. Lib-Tech’s VP of Marketing, Pete Saari says, “Snowboarding’s seasonality keeps it fresh and exciting every year. Shops don’t seem to be overburdened with inventory the way the surf industry has been post-covid. All we need is snow and the good times roll”.

Yet some see it differently, like Andreas Kramer from Double Deck. He states, “The snowboard market is currently still in decline, but seems to be open to new products and innovations. With our new snowboard technology we have the feeling that the market will accept exactly that. We also have the feeling that with this product [Double Deck’s proprietary design] we can potentially make the snowboard market grow again”. On a mission.

On another note, Démir Julià, general manager at Verdad states, “Big Brands are trying to kill all the small brands. Luckily small brands have the nicest boards and designs so they can survive. [These smaller brands survive] Thanks to the core riders, without their support there would only be uniformity”.

The boys at Korua note that business chases snow and that winter sports are facing political challenges in Germany, Austria, and Switzerland. Amplid’s master of ceremony, Peter Bauer, emphasizes, “Winter tourism as being the scapegoat of all media is also something we have to deal with. But Amplid has been growing strongly during the past four years, it seems there is a place for a dedicated snowboard brand in the mid to high-end market, even in difficult times”.

Slash Snowboards founder & owner Gigi Rüf tells us they are carrying their 23/24 board line forward to 24/25 due to the amazing reception it received at retail. Last winter Gigi introduced TopART, decals that allow the user to DIY their board with select collaborators. Slash worked with Crazy Shop in Spain for a run of TopART decals to celebrate their 25th anniversary this winter. To accompany the TopART stickers, Gigi produced a blank version of their best-selling Happy Place board this winter. So that retailers have some newness next winter, Gigi’s giving three Slash boards the TopART Edition treatment (clean, blank topsheets with subtle Slash branding) and will also be releasing a collab board and Union binding with hype illustrator (and former snowboard shop kid) Thumbs.

Mas, the 100% rider-owned and operated brand from Turkey, has a close connection to the end customer and the nearest ski resort is one hour away from its factory. This allows the founders to rigorously test and analyze each snowboard they produce. Cofounder Alp Demiralp explains, “Snowboard production needs new technologies and improvements more than ever due to climate change. This challenges us to evolve to our best. Last winter, the snow level was low in Turkey and we also experienced a big earthquake. We have a large network and we believe that we will overcome this with ‘the right price to the right customer’ policy. Hopefully, with the early snowfalls, this year will be better than the previous one”.

At Telos, European Sales Manager Kolja G. Keetmanassesses says: “We’re strengthening relationships to our local retail partners and our consumers and we get a lot of positive feedback on the actual strategy of keeping the full line carry-over for 24/25. We started this season to shift all online channel direct sales to the closest retailer to the consumer and we are supporting local retailers even if they’re not yet existing pre-order clients”.

Finally, for Joe Sexton at Public, the big picture looks a bit more positive: “I think the current state of the snowboard market is hopeful, it’s cool to see brands putting a focus on the culture of snowboarding. Challenges would be logistics issues and supply chain issues. The brand really can’t navigate them as most of the time they are out of our control, it’s just doing the best we can”.

Last but not least, Goodboards’ Founder Josef Holub nails it: “The most important thing is to motivate the customers to go back to the mountains and snowboard. That’s why we organise over 50 test days”.

When asked about physical retail, everyone agrees that brick-and-mortar is a big strength for the industry and nothing will replace the service and engagement you find on a shop floor. This is nicely illustrated by Amplid’s Peter Bauer: “The retailers still provide those ‘temples of stoke’, which we all need to keep the psych-level up. A cool store is an important brick in our culture”. Word.

STRATEGY

In order to succeed at all levels, brands are building and strengthening their own vision on how things should be run. At Drake, Davide Smania, product and marketing manager offers, “We just introduced two models which are a more affordable version of already existing ones, same shapes but with simplified construction in order to serve also those customers which don’t have a big wallet. Being [value-oriented] is always well appreciated in this economic situation, not everyone can afford an expense of 500 euros or more for a snowboard”. Commitment to small budgets.

Capita stands behind its facility – the Mothership – and values sourcing raw materials close to it. Mark Dangler insists, “We have a unique position in that 98% of our materials for production are sourced within a five-hour drive of The Mothership. We continue to strive to find ways to strengthen our localized supply chain, which we have done so with certain wood core types this season. As far as pricing we have seen a continuation of customers gravitating towards higher-end premium products in the collection”.

For Never Summer, being a product-driven brand allows the company to connect with core customers and new ones through an emphasis on quality. Tony Sasgen, international sales manager, emphasizes, “I believe the core snowboarder appreciates durability and craftsmanship over hype, probably more now than ever. When buying new gear, customers want to have the comfort that their money is being well spent on products that last. Therein lies the opportunity and we fit that description of products that are built to last”.

Borealis’ Ben Hall justifies the company’s recent big developments. He notes, “We moved 100% of our production to GP87 last year as they produce the highest quality snowboards on the planet. This move increased our costs and the price of our gear quite significantly but we did this for super positive reasons: to shift towards ultra-premium quality and increased performance, which is why we now have a 4-year guarantee on all our gear”.

Many small labels are also showing interesting concepts and alternative offers. Matts Drougge, shaper and owner at Stranda says, “We can see a growing interest in boutique brands like us. Sales have been really strong so far this season. The more mature riders are looking for and are prepared to pay a premium for high-end snowboards”.

Tur is a relatively new, small brand looking for growth but without losing the brand’s DNA, which is rooted in high quality and premium products. “At the moment we are selling our products with low margins to keep the end price to consumers down as much as possible [and] to be able to introduce our products to a wider audience”, explains Product Manager Jörgen Svedberg.

Silbaerg, the small German brand, is focusing more and more on the niche in the high-price segment and driving B2C sales via its own webshop. Founder Dr. Jörg Kaufmann, says, “Another mainstay are customized snowboards, i.e. we can adapt the complete shape, flex and design to the individual customer’s wishes. However, this only works in the premium niche”.

Jure Sodja, co-owner at Moonchild, introduces the small brand: “We remain committed to our niche within the market, specializing in freeride and powder boards. While the snowboard industry evolves, we continue to work diligently to develop high-quality products that cater to the needs of our dedicated customer base”.

Kjetil Bjørge at Fjell puts it in three points, “Market and interest seem [to be] increasing. [The challenge of] rising prices at every level is demanding. [We are focused on] calculated production and detailed future planning”. Straight to the point.

An old dawg from the industry, Rad Air’s Harry Gunz and his Tankers reminds us that “We focus on the longboarding market (a niche within the niche) and it’s hard to convince dealers/shops to carry such an exclusive line. That’s why the online market has become important to us. End users know what they want and are searching for the right product”.

As you can see, many small labels are moving and shaking the industry with outstanding concepts and brilliant ideas. It’s up to distros, reps, and retailers to give them a shot!

Other brands are working through their range and category to access the market and reach informed customers. Consequently, brands are covering all areas of snowboarding – and it’s for the good of the retailers.

As an example, Elevated Surf Craft continues to develop the range of its quiver and aim its pricing to fit with the niche and specialty style market. Aaron Sababba, owner and shaper proposes, “Implementing techniques like payment plans and communicating the longer lifespan of our product seems to allow for slightly higher than normal pricing”.

For 24/25, Arbor has reduced its overall SKU count and has repositioned its offering to be easier for retailers & consumers to digest. Product Marketing Manager Eddie Wall emphasizes, “We will be focusing heavily on our athlete marketing strategies and the products that tie into these stories, which should drive sales into our top-selling SKUs and reduce excess inventory”.

Reflecting on an interesting direction at YES, Brand Manager David Pitschi explains, “In this year one of the merger we have made a strategic move to talk to the younger audience and the more freestyle part of the snowboarding offer. We have multiple twin and directional twin boards to fit all freestylers out there”.

Davide Smania at Drake observes, “It seems that particular shapes and geometries gained their niche, but in general we noticed a certain interest in having versatile boards you can ride and have fun in different conditions. We are covering different shades of the all-mountain category”.

Nidecker sees the snowboard market growing in two distinct segments: all-mountain boards and freestyle-specific twin shapes. Antoine Floquet, product wizard, explains, “As the leading manufacturer of all mountain essentials, we naturally address the first segment right across the line, but we’ve also expanded our true twin collection to offer everything from easy-riding jib boards to the Sensor PRO – Mons Røisland’s weapon of choice”.

The market for Roxy is a diverse range of female participants. Barret Christy Cummins dissects this: “Fans of the brand [include]outdoor adventurers, cultural leaders, competitive pros, and casual enthusiasts, and our line addresses the needs of these consumers across the youth and adult market. Trends in women’s products are similar to that of the market as a whole, with an increased awareness of camber hybrids and consideration of environmentally friendly products”.

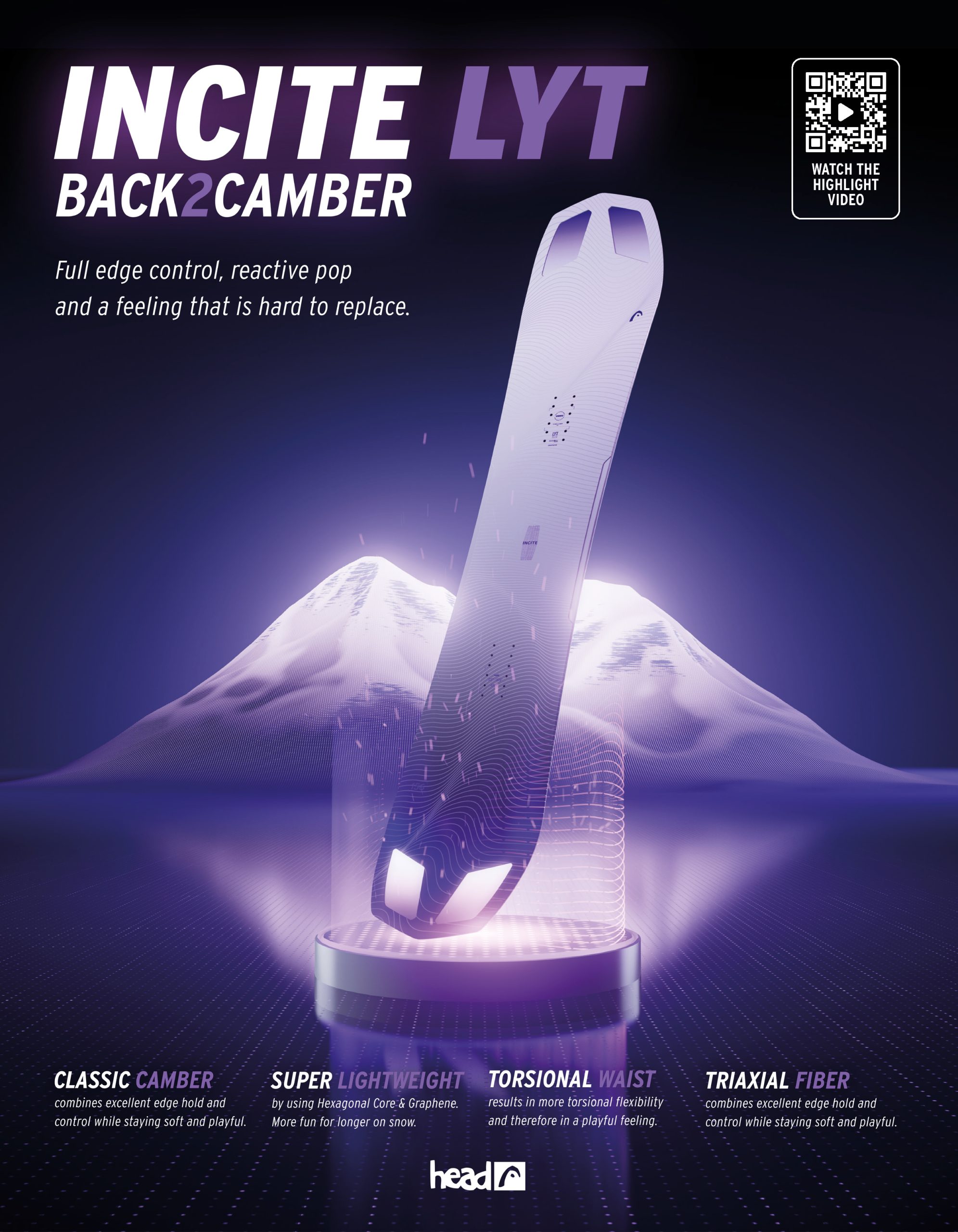

Katharina Acham, operative marketing manager at Head claims, “We are looking ahead to season 24/25 with confidence as the orders are high again and we will start the season with a great and strong product mix developed in close coordination with our business partners”. Finally Stephan Schauer at Ride concludes the topic with another straight and forward claim: “Keep on producing good stuff. We have great products. We’re gonna sell them”. On a mission.

WHAT’S INSIDE?

For the 24/25 line, Vimana has reinvented a lot of its bestsellers, offering new shapes with fine-tuned and tested sidecuts. Trond-Eirik Husvæg details, “We will also introduce our new seamless sidewalls, which are custom to every single shape and length. The biggest plus with this is flex control and boxing in the sandwich construction perfectly. All our products are dictated by our team of riders. Every single Vimana board has a specific purpose”.

There’s a lot of new stuff from Rome, as the 24/25 collection finds the brand with a new logo package, which is prominently displayed on boards’ bases. Matt Stillman, vibe merchant, adds, “To complement the new, refined logo, we also have new brand colors designed to evoke a clean, modern feel. A cool slate gray with hunter orange accent creates an approachable and timeless visual sensibility. We also set out this year to add more colour to the line; bright hues of purple, acid yellows and shades of bone accent the new brand colour palette”

Moonchild has established the Moonchild Skunkworx division to build experimental boards and test new shapes. Three snowboards, which are truly unconventional and offer new sensations on snow, have been launched under the Skunkworx brand. One of those boards is a hybrid snowboard that can be ridden as a powsurf, splitboard, or traditional snowboard.

Amplid launched its “Hollow Project” last season – making a superlight powder board, with 80% of the surface area being translucent. Bauer adds, “Very likely we will launch a ltd. edition this season, depending on how quickly we reach the go-to-market stage with this new technology”.

Academy keeps it simple: Sintered bases are featured on every Academy Series. “We use only the best materials available. Why would you buy an expensive car with crappy extruded tires?” asks Jeff Baughn.

“Bataleon remains at the forefront of 3D snowboard shapes, propelling us continuously toward change and innovation, which remains our defining trait”, reminds Rubby Kiebert, Bataleon’s sales director. He continues, “Our recent endeavors include a comprehensive overhaul of our freeride line, alongside the reconfiguration of the popular plus series, now featuring the newly introduced women’s Push Up+”.

YES is coming up with many bangers this year. It is introducing a new main technology, its Y3D bases with the sidekick technology associated with it. Pitschi explains, “We’re benefiting from those technologies thanks to the merger with Lobster. Y3D is the YES three-dimensional base, it brings more playfulness in the park boards and more floatation in the powder boards. The sidekick technology helps the rider to have a smooth ride in chatter by flushing out the excess snow before the edge catches”.

Last year brought big developments at Lib-Tech, including Mike Olson’s new Techno Pop construction on the Apex Golden Orca and Mikes Magic BM. Techno Pop includes recycled PET foam from plastic bottles, Ultra high strength Magnesium fibre that reduces weight, and strategically placed structural carbon that adds pop and liveliness. Pete Saari offers, “This year we are trickling some of that lightweight poppy tech into other models in the line including the large, long Dough Boy Shredder, the hard carving, side hit blasting, pow floating resort ripping Double Dip, the high performance freestyle TRS series, and our all new smooth-riding, high performance women’s directional all mountain freeride Theda model”.

Burton’s focus in boards is freeride performance, that’s where the brand puts the energy when it comes to new shapes and innovation.

Never Summer’s biggest innovation over the last couple seasons has been the Triple Camber profile and edge tech that has gained momentum with its core customer base and beyond. Tony Sasgen states, “When you put the Triple Camber models on edge you will feel the additional contact points doing the work and digging into any snow or ice you put under it. It works, try it for yourself and see”.

At Rossignol, innovation will come from manufacturing processes, organizational behavior, and renewable feedstocks as much as from board construction and shapes. The brand is focused on reducing its carbon footprint and controlling pricing.

Korua keeps the line steady as it carries the collection over for next season. Improvements in detail are kept under the radar. For bigger innovations, have a look at their concept boards where snowsurfers with shifting bindings are in focus.

At Arbor, the majority of the snowboards have Real Wood Powerply topsheets. The models that do not implement the Powerply use a bio-plastic topsheet. All Arbor snowboards have recycled steel edges, recycled ABS sidewalls when applicable, bio-resin, and sustainably sourced Poplar and Paulownia wood cores. They are factory-tuned, factory-waxed with Wend Natural Wax, and manufactured with 100% solar energy. Another full commitment to sustainable construction.

Talking about sustainability, Capita’s story is consistent. The CAPiTA Mothership is its production home in the Austrian Alps and the first true 100% clean energy snowboard manufacturing facility in the industry.

As for Borealis, Ben Hall explains, “Since it was launched in 13/14, we’ve been focusing on using sustainable materials wherever we can: organic bamboo top sheets, sustainable wood, zero-COV resin, flax pads, recycled steel edges, biodegradable wax, bioplastic top sheet, etc. But most importantly, we believe in building long-lasting and high performing snowboards – each of our boards is designed to have a long life and that is a core element of sustainability”. On another note, DoubleDeck Snowboards has developed a special return policy for rental stations. At the end of the season, rental stations return their boards to the company, which then recycles the material and makes new boards out of it.

Following the 23/24 debut of Jones’ groundbreaking Re-Up tech stringers that are made with materials recycled from dead snowboards, this next season the focus is on creating a snowboard recycling program that will help secure the supply of dead boards it needs to introduce Re-Up technology into more board models.

Lately, 100% of Nidecker’s suppliers have signed the Nidecker Code of Conduct & Environmental Policy. Floquet insists, “It’s a pretty exhaustive document that we hope will help to set the standard for our industry”.

Silbaerg started with the first snowboards made of hemp fiber in 23/24, although the material costs are currently extremely high (even higher than for carbon fiber). In 24/25, the brand will further expand its range with natural fibers.

Nitro Founder Tommy Delago states, “On construction, sustainability is more important than the next new exotic high-tech fibre. Some claims are pretty wild, though, and we will need some ways for the consumer to gauge the promises made by suppliers against the reality”. Two worlds.

IN SHORT

Bataleon is introducing a new board to the collection. The TURBO is a competition-specific model tailored for elite riders. Kiebert says, “This season, we’re thrilled to announce we will produce the inaugural Bataleon team video, ‘Flat Earth’, this movie will stand as a testament to our unyielding dedication to snowboarding culture and our fervent support for the riders who define our identity”.

Mas Snowboards is also working on a team movie for next year. “It will be a big production. We hope that this movie will be appreciated by many snowboarders. It will also be a good opportunity to explain ourselves,” says Demiralp.

Weston’s 24/25 line is seeing a redesign of the Range and Rise – its men’s and women’s all-mountain category splitboards and solid board counterparts. Sean Eno, director of marketing, says, “Overall, we’re not changing the game in 24/25 in terms of anything drastically new in shaping, but we are putting more emphasis in our powder and freeride categories”.

For 24/25, Jones is focused on offering more models designed for the intermediate all-mountain rider and the expert freestyle rider. “These are both growing customer categories and we are excited to offer these riders more responsibly made board options with Jones’ signature performance”, elaborates Ruairi Collins, Jones’ European marketing manager.

Dupraz remains focused on the concept of having one board that offers tremendous performance – no matter the snow conditions.“[We are] More efficient than ever with the evolutions we always bring in the construction, while keeping our different shapes”, says Serge Dupraz.

Roxy’s range spans the full spectrum. Inspired by and focused on the mountain and wave lifestyle and the communities that surround them, Roxy proposes all mountain boards that encourage participation and accessibility to this lifestyle and community continues to be its focus.

The Niche line for 24/25 was graphically inspired by the realm of the fae, and features ethereal, mysterious graphics created using old-world illustrative techniques like charcoal and pen and ink. The lineup is focused yet offers something for each type of rider, whether it be splitboarding, freeride, freestyle.

Public’s Sexton notes, “Our focus is to market to snowboarders! Anyone who likes to slide sideways on snow is our ideal customer”.

Lib-Tech’s Pete Saari concludes, “We love snowboarding and snowboard building. We are all in every day, all year, and have been for four decades. We try to make every step and every component that goes into a snowboard a magical story from a happy craftsperson, to an environmentally friendly process and materials, to an amazing artist, to an extremely happy shredder/dreamer board curator”. Passion at its finest.

Goodboards ends it with the motto: Think positively, be patient, go riding with customers and have fun! Full program.

The next steps in shaping the industry are up to you. Ask questions, talk, test, push, carve, pop, and lift all of the amazing tools brought by these brands and manufacturers. As happiness is sometimes hidden in the unknown, I invite you to surprise yourself with a new concept or simply something you didn’t know about previously. ‘Cause if you don’t try, you’ll never know. See you on the snow!